This product is for informational purposes and may not have been prepared for or be suitable for legal, engineering, or surveying purposes. 2556 Rockwall CAD (Tax Office) 3039 Utility Tax Service, LLC.

COLLIN COUNTY CAD CODE

Owners do not have to render exempt property, such as church property or an … The mission of the Collin Central Appraisal District is to appraise all property in the Collin County Appraisal District at market value equally and uniformly, and to communicate that value annually to … This application is for use in claiming property tax exemptions pursuant to Tax Code §11.18.

This application covers property you owned or leased from the state or political subdivision of the state on January 1 of this This product is for informational purposes and may not have been prepared for or be suitable for legal, engineering, or surveying purposes. Property includes inventory and equipment used by a business. Collin Central Appraisal District Interactive Map Disclaimer.

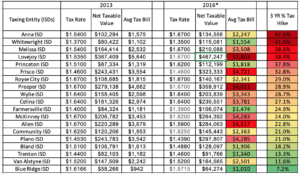

It does not represent an on-the-ground survey and represents only the approximate relative location of property boundaries. View tax rates for cities and schools in Collin County. A rendition is a report that lists all the taxable property you owned or controlled on January 1 of this year. The official website of the Collin Central Appraisal District If you own tangible personal property that is used to produce income, then a rendition must be filed with the Collin County Appraisal District by April 16, 2012. I Agree 2669 You may use this form to revoke an Appointment of Agent for Property Tax Matters. The official website of the Collin Central Appraisal District, For more information about appealing your property's valuation, reference the, Click here for more information about this site's minimum requirements, Lessee’s Designation of Agent for Property Tax Matters under Tax Code Section 41.413, Lessee's Designation of Agent for Property Tax Matters, Appointment of Non-Agent Representation Form, Application for Charitable Organization Property Tax Exemption, Application for Religious Organization Property Tax Exemption, Appointment of Agent for Binding Arbitration, Motion for Hearing to Correct One-Third/One-Fourth Over-Appraisal Error, Motion to Correct 25.25(c) Alleged Error in Appraisal Roll. This application covers property you owned on January 1 of this year or acquired during this year. You're using an older, unsupported browser which may have an impact on how this site is rendered. There is no fee to file the homestead exemption form.

0 kommentar(er)

0 kommentar(er)